It’s never pleasant to think about your death, but creating a will is a vital step in planning for the future. It ensures that your wishes are carried out after you're gone and prevents the inevitable family conflict that often comes with uncertainty. You can make things simpler for yourself and your loved ones by making sure you’ve covered all avenues. Once it’s done, you never need to think about it again.

Digital Assets

It’s easy to overlook as an unimportant entity, but in the age of technology, digital assets like social media accounts, email addresses, and online subscriptions need to be managed after you’ve gone. Consider how many online accounts you have, and you’ll appreciate the issues that someone might face. Designating a digital executor ensures your online presence is handled according to your wishes.

Pet Care

Your furry friends need a plan too, and you’ll no doubt want them to be loved and cared for with the same amount of vigour. Specify who will take care of your pets and set aside funds for their care to ensure they’re well looked after. They’re precious, and you must have peace of mind about their care.

Sentimental Items

Heirlooms and any other items with sentimental value might not have monetary worth, but they hold emotional significance for you, and certainly to those who inherit them. Clearly state who should inherit these cherished possessions and choose carefully. You want to be sure that they’ll be looked after as you have done.

Personal Letters

While it’s by no means a legal necessity, leaving personal letters to loved ones can provide comfort and closure in the days following your death. It’s a heartfelt way to express your thoughts and feelings one last time and gives them something to cherish.

Charitable Donations

It isn’t everyone’s choice, but if you have causes close to your heart, consider leaving a portion of your estate to charity. It’s more common than you think, with many people choosing to support charities after they’ve gone. This ensures your legacy continues to support important work, and what a great legacy that is.

Guardianship for Kids

It’s at the top of the priority list ensuring that young children are looked after. This decision makes sure that your children are cared for by someone you trust if something happens to you. Bear in mind that this is the most important decision you’ll ever make, so do so wisely and with plenty of thought and consideration.

Funeral Preferences

It can be hard for families to make funeral arrangements in the throes of grief. Detailing your funeral preferences can relieve your family of making difficult decisions during a stressful time. Specify your wishes for burial or cremation, service details, and anything else you consider important for your send-off.

Business Succession Plans

If you own a business, you’ll need to outline how it should be managed or transferred. It’s a huge decision to make, and not one that can be taken lightly. Whether you choose to close the business or hand it to someone else, make sure this is established in your will. It ensures continuity and protects the livelihoods of employees.

Outstanding Loans and Debts

You should always provide instructions on how to handle any debts or loans after your death. It doesn’t mean that you’re handing them over to someone else, it just helps your executor manage your financial obligations effectively. It’s always sensible to work towards paying off any outstanding debts for ease.

Care Instructions for Houseplants

It might sound bizarre, but if you’ve spent years rearing a houseful of plants, they need to find a new home. If they’re important to you, specify who should inherit and care for your houseplants to keep them thriving. Make sure you choose someone who won’t forget to water them.

Vacation Properties

If you’re lucky enough to own vacation properties, make sure you outline how they should be used or maintained. You may choose to sell before your death, but if you plan to keep them in the family, including instructions prevents disputes and ensures they’re enjoyed by future generations. If you’re keen to keep a property in the family, share your wishes with loved ones and hand over ownership appropriately.

Collections

Whether it’s stamps, coins, or vintage records, if you’ve built up a large collection of items over the years, you’ll need to specify who should inherit them. Collections take a long time to build, and some can even be valuable down the line. It might be that you want to offer the joy of collecting to someone or hand them over for potential monetary purposes. Just make sure they go to someone who will appreciate them.

Passwords and PINs

They’re the bain of everyone’s lives in the modern era, but you will need to provide a secure way for your executor to access necessary accounts. No one wants to be guessing codes, numbers, and digits for weeks on end, so make it easy by outlining the process of managing your estate.

Vehicles

If you own a vehicle, you should specify who should inherit your cars, boats, or motorcycles. Some people choose to sell them before their death, but others like to pass them on to family members, particularly if they’re new models. This ensures they’re passed on to someone who will value them.

Jewelry

Every family member loves holding onto a favorite piece of jewelry following a loved one’s death, so clearly state who should receive your much-loved bracelets or watches to avoid potential conflicts. It could be that you’ve had something in the family for years, so choose someone who will cherish these items and continue the tradition.

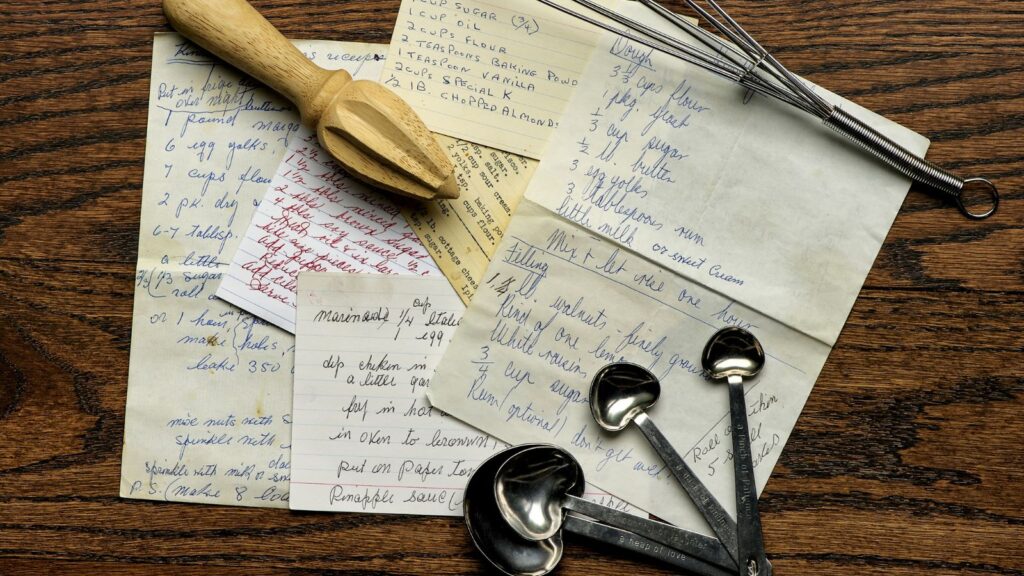

Family Recipes

Passing down family recipes keeps culinary traditions alive, and many families own homemade cookbooks with famous family recipes. If you want to pass on your great-grandmother’s secret chili con carne recipe, include these cherished instructions to ensure they’re enjoyed for generations to come.

Photographs and Videos

Whether it’s physical scrapbooks or digital pictures, you can choose who you’d like to inherit family photos and videos. These items hold significant sentimental value and should be preserved for years to come. It might be that you pass different pictures to a few people, just make it clear what your wishes are.

Unfinished Projects

If you have any unfinished projects, like a book or artwork, outline what should be done with them. This ensures your creative efforts are respected and possibly completed. You never know, your grandson might finish your novel and become the next J.K. Rowling. What a legacy. See, it doesn’t have to be all bleak.

30 Traditional Sayings That Are Now Considered Offensive by Woke Culture

30 Traditional Sayings That Are Now Considered Offensive by Woke Culture

21 Habits Often Associated With Having a Lower Social Status

21 Habits Often Associated With Having a Lower Social Status

25 Social Issues Gen Z are Determined to Cancel