A part of the American Dream is living a comfortable middle-class lifestyle. Since the global pandemic in 2019, this dream has been shattered. The rising cost of everyday goods and unaffordable housing leaves many struggling to meet their financial commitments. Here, we look at how the middle class is being affected by money problems.

The Rising Cost of Living: A Daily Battle

The American economy has avoided recession, and inflation is beginning to slow. This should be good news, but for many, the cost of living is unmanageably high. Middle-class families have been hit especially hard; childcare and housing costs are two areas they struggle to afford.

Healthcare Costs: An Unmanageable Burden

The middle class is the demographic with the most medical debt. Those earning between $50,000-$100,000 yearly have the most unpaid medical bills. Health insurance is not a guarantee of keeping the bills down, either. Higher levels of education and awareness of medical conditions mean they seek care when lower-income families do not, adding extra costs.

The Impact of Stagnant Wages

Wages are starting to increase, but this is after a period of stagnation, and families are not feeling the benefits. The price of groceries and housing has risen through inflation; with wages not rising, families have struggled to keep up with costs. Cutting back expenditure on groceries and childcare has an added cost of mental and physical health effects.

Education Expenses: A Financial Strain

Families have the added burden of putting their children through higher education. Middle-class families had previously been able to put away money towards a college fund, but that is increasingly difficult when the money is needed elsewhere. When it is time for their children to go to college, loans are the only option.

Housing Affordability Crisis

The COVID-19 pandemic allowed homebuyers to get mortgages at cheaper rates. After the pandemic, rises in interest rates due to inflation have left many with mortgage payments they can't meet. There is also a lack of affordable housing and not enough homes being built to meet the demand and lower prices.

The Burden of Student Loans

A college degree translates to higher earning potential, but with wage stagnation, student loans are a burden. Monthly repayments start when students leave college, and some can't meet all their payments. High interest rates also leave them paying the loans for the rest of their lives.

Credit Card Debt: A Growing Concern

The number of people making purchases using credit cards is on the rise. Not having access to liquid cash makes credit necessary when purchases are essential. This becomes problematic when monthly repayments can’t be made because living costs are so high. It has a knock-on effect of lowering credit scores and restricting access to credit in the future.

Childcare Costs: A Major Expense

As childcare costs spiral, more families take their children out of daycare. This can mean a parent has to give up their job or work part-time. It is a more affordable option, but losing an income adds financial pressure, so more families are turning to credit and increasing their debt.

Retirement Savings Falling Short

Dreams of an early retirement have been shattered by wage stagnation and inflation. The ability to save money is impossible for many middle-class families. Having to work past retirement age is looking more likely for many.

Emergency Funds: A Missing Safety Net

Anyone who owns a house or a car knows that something will go wrong, and access to cash is necessary to fix the problem. For many, this is no longer possible; all their money is being spent each month. In an emergency, the only option is to get further into debt.

Balancing Debt and Daily Expenses

Falling into debt increases the financial and mental pressures on families. Debt for the middle classes is not a new phenomenon, but they were able to pay off their debts at the end of each month. It was also taken on for non-essential purchases. The new reality is deciding how much to cut back on everyday expenses so they can afford to pay off loans.

Impact of Inflation on Everyday Life

The middle-class dream is based on the idea of living comfortably without worrying about every purchase made. This is no longer possible; inflation has seen the price of everyday items rise to unaffordable levels.

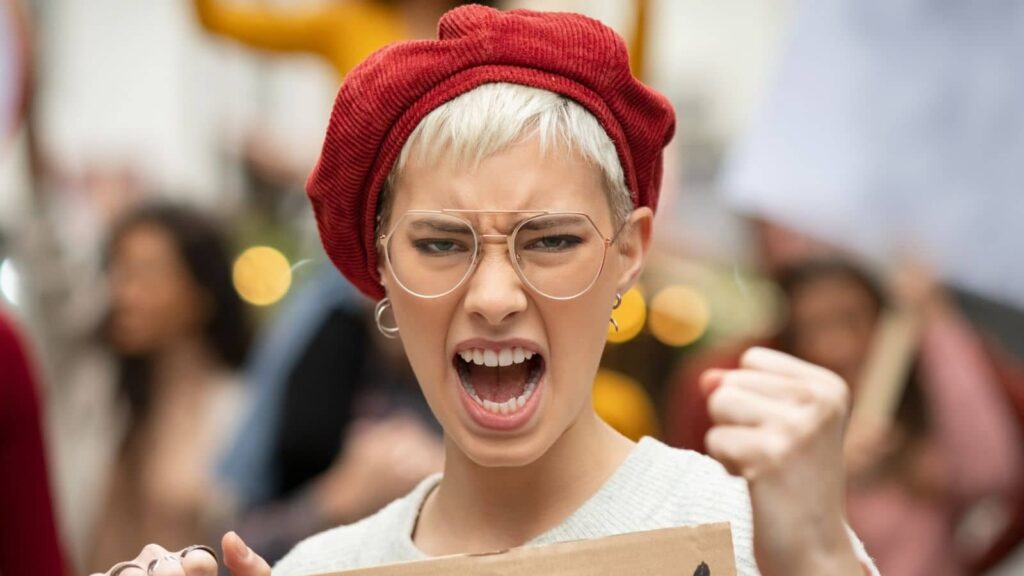

Job Insecurity and Economic Anxiety

Job insecurity is one of the biggest fears for the middle class. With debt payments to manage and family costs, the fear of losing a job is a terrifying prospect. There is also worry that the economy won't improve in the short term. Money is an overwhelming concern for the middle class, much more than social and cultural issues.

Middle-Class Tax Burden

Earning more means paying higher income tax rates, but this isn’t the only tax burden. Property taxes must be paid annually, and with the rising cost of essential goods, sales taxes add more financial pressure. Tax becomes more of an issue when wages are not rising, which causes a real increase in taxes paid.

The Challenge of Maintaining a Comfortable Lifestyle

A comfortable life means different things to different people, but the general idea is to afford extras without worrying. Fewer middle-class Americans are taking vacations, or they are finding cheaper alternatives. They are also cutting down on other costs associated with living a comfortable lifestyle.

Transportation Costs: A Hidden Expense

Transportation costs in America are higher than in any other industrialized nation. Middle-class families often live in suburban areas without public transportation, so running a car is necessary. If they have more than one car, the costs increase; it is an expense that can’t be avoided.

Rising Utility Bills

The cost of electricity and gas has risen, and hotter summers increase electricity usage. Families face large bills that they struggle to pay. There are a record number of middle-class people behind on their energy bills.

The Role of Financial Literacy in Economic Struggles

Managing money is an essential life skill, and financial literacy should be taught more throughout the education system. This does not mean all economic problems can be reduced to poor financial skills. Some circumstances can’t be mitigated, and the current cost of living crisis is one of them. The global pandemic was a once-in-a-lifetime event with economic repercussions that are still felt.

30 Traditional Sayings That Are Now Considered Offensive by Woke Culture

30 Traditional Sayings That Are Now Considered Offensive by Woke Culture

21 Habits Often Associated With Having a Lower Social Status

21 Habits Often Associated With Having a Lower Social Status

25 Social Issues Gen Z are Determined to Cancel